Latest stats on real estate in the Cayman Islands

At the time of writing, the US economy is anticipating another interest rate hike (predicted to happen before the end of the year) with two more expected in 2019. Also, we recently received the latest statistics courtesy of Cayman’s Economic and Statistics Office with regard to the latest Consumer Price Index figures at the end of June 2018, which showed a rise of 4.8 per cent over the same quarter in 2017.

I thought, therefore, it would be timely to discuss how I see these economic factors impacting Cayman’s real estate market. In particular, it is worth exploring whether Cayman’s bullish real estate market is going to continue if interest rates continue to increase.

Economic factors impacting Cayman’s real estate market

My thoughts are that the primary challenge will be for those who need financing for their real estate purchase. Obviously, those who pay cash for their properties won’t be impacted in the same way. Those who need financing will be affected by increases in rates because it means they will be able to borrow less while paying more for their mortgage. As a result, I believe the demand for property by the local residential market (who in the main require a mortgage) will be impacted in part.

One of the bigger concerns in my mind is the CPI figure, which showed a substantial increase of 4.8 per cent year-on-year. This increase in the cost of goods and services in the Cayman Islands will impact how much a household has to spend, which will impact their ability to borrow. Between both economic triggers I believe they will create challenges in the acquisition of property for some people.

The increase in the CPI also demonstrates an increase in the cost of building materials, in a market that has already seen an increase due to recent US-imposed tariffs on such goods, which has not been fully absorbed to date. This could potentially mean a slow down for the construction industry which is currently booming.

However, to combat this possibility, we are fortunate to still possess all the factors that make the Cayman Islands an attractive location for people to move here (of which I have discussed many times in this column), from a fantastic lifestyle all the way to a safe and secure environment. There are still jobs that need to be filled and as a result, people still need housing.

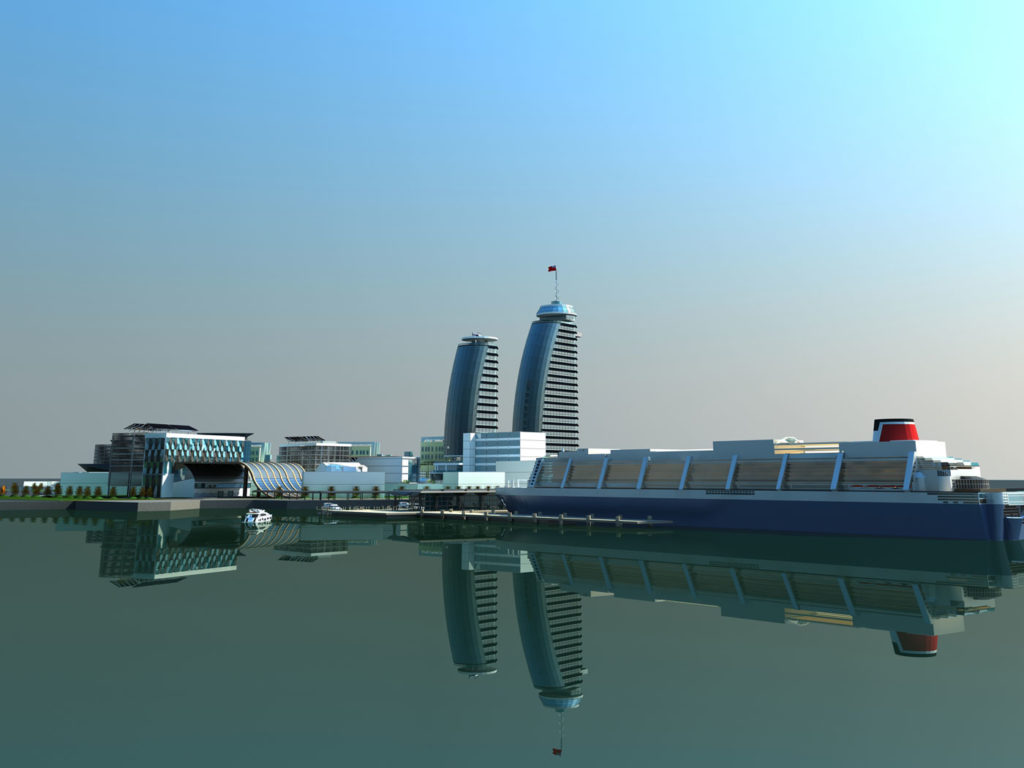

For cash-rich overseas investors, I see the impact from the interest rate increases as far less, especially when you consider that 95 to 98 per cent of Seven Mile Beach or waterfront purchases are by cash buyers.

We may find 7MB owners/investors might want to realise a return on their real estate investment and put their property on the market to enable them to then place the cash released from the sale into high interest-bearing instruments. This could then release some much-needed inventory into the Seven Mile Beach market.

If interest rates go up, it will have a global impact, so Cayman needs to maintain its competitive advantage to stay above the rest. The factors driving Cayman forward will still attract people to our shores and while we may pause for consideration, as there is so little inventory on Seven Mile Beach – and we see this situation continuing for the next couple of years – I don’t see this market being hugely impacted.

If you are planning to buy a property in the Cayman Islands or looking for an investment opportunity, keep visiting our blog for the latest news, market trends, exclusive property news and tips. Feel free to share your comments and views.